What Is the FIFO Method?

This means that older inventory will get shipped out before newer inventory and the prices or values of each piece of inventory represents the most accurate estimation. FIFO serves as both an accurate and easy way of calculating ending inventory value as well as a proper way to manage your inventory to save money and benefit your customers. Those goods are put on shelves or stored in a warehouse until they sell. These finished products, as well as the parts and materials required to make them, show up on the company’s balance sheet as an asset called inventory.

Profit and Loss Statement: What is it, Template & Analysis

FIFO is calculated by adding the cost of the earliest inventory items sold. The price of the first 10 items bought as inventory is added together if 10 units of inventory were sold. The cost of these 10 items may differ depending on the valuation method chosen. To determine the value of inventory assets using the average cost method, you simply divide the total costs paid for inventory items by the number of units received.

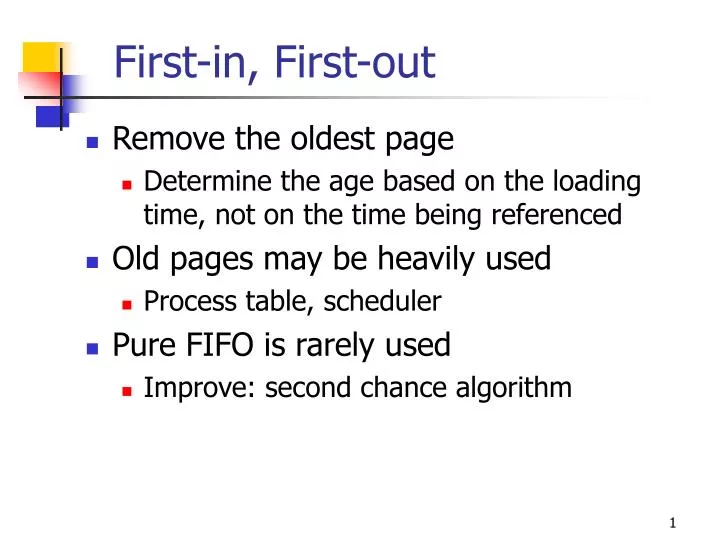

First-In First-Out (FIFO Method)

Its leader, Elon Musk, has become a close ally of Trump’s, and its stock jumped nearly 15% the day after the election and has kept rising. McBride’s key priorities for her congressional run were expanding access to affordable health care, protecting reproductive rights and increasing the minimum wage. During her first term, she helped pass universal paid family and medical leave across the state. First In, Last Out, is one of those Shotguns that has stood the test of time. It’s an Arc Shotgun available at launch, which was then re-released during Season of Arrivals.

FIFO vs. LIFO

Average cost inventory is another method that assigns the same cost to each item and results in net income and ending inventory balances between FIFO and LIFO. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any see top 10 analytics and business intelligence trends for 2021 security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision.

The Difference Between FIFO and LIFO

Note that the $42,000 cost of goods sold and $36,000 ending inventory equals the $78,000 combined total of beginning inventory and purchases during the month. Determine the cost of the oldest inventory from that period and multiply that cost by the amount of inventory sold during the period. But when using the first in, first out method, Bertie’s ending inventory value is higher than her Cost of Goods Sold from the trade show.

Things are always changing in business, including the cost of raw materials, intermediate goods, and wholesale products. That means every item in a company’s storeroom or warehouse was probably purchased at a different price. As a result, keeping track of how much money is tied up in inventory (items held in stock for future production or sale) can be a challenge. One option for tracking the value of what’s in stock is to assume the oldest products on the shelf are the ones you push out the door first. This first in, first out (FIFO) method is a common accounting technique to avoid tracking every individual piece of inventory as it is sold.

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. With over a decade of editorial experience, Rob Watts breaks down complex topics for small businesses that want to grow and succeed. His work has been featured in outlets such as Keypoint Intelligence, FitSmallBusiness and PCMag. Jeff is a writer, founder, and small business expert that focuses on educating founders on the ins and outs of running their business. From answering your legal questions to providing the right software for your unique situation, he brings his knowledge and diverse background to help answer the questions you have about small business operations.

- While it’s useful to have a basic understanding of how to use the FIFO inventory method, we strongly recommend using accounting software like QuickBooks Online Plus.

- To calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6 price.

- Using the FIFO method, the cost of goods sold (COGS) of the oldest inventory is used to determine the value of ending inventory, despite any recent changes in costs.

This makes it easier to accurately account for your inventory and maintain proper FIFO calculations. In some cases, a business may use FIFO to value its inventory but may not actually move old products first. If these products are perishable, become irrelevant, or otherwise change in value, FIFO may not be an accurate reflection of the ending inventory value that the company actually holds in stock. To calculate the value of inventory using the FIFO method, calculate the price a business paid for the oldest inventory batch and multiply it by the volume of inventory sold for a given period. For example, say a business bought 100 units of inventory for $5 apiece, and later on bought 70 more units at $12 apiece.

Whether you’re a PvE or PvP player, there is one out there for you, you just need to wait for it to drop and then lock it immediately. Take a look at our comprehensive collection of god roll recommendations on our Destiny 2 Strategy Guide. There are a lot of good Shotguns out there for PvP, and First In, Last Out belong alongside your collection. This god roll utilizes Slideshot and Opening Shot to surprise your foes. By sliding, you can boost the gun’s effective range to maximum (with the help of the other elements), which can nail an opponent quite far away.